- Casino

- By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

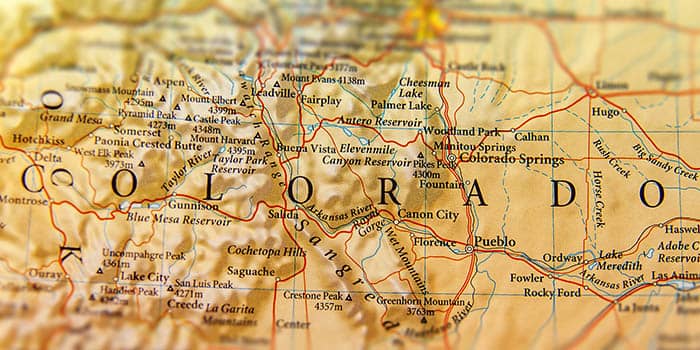

- Colorado

- Connecticut

- Delaware

- Georgia

- Florida

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Massachusetts

- Maryland

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

- By State

- Slots

- Poker

- Sports

- Esports

Gibraltar Raises Corporation Tax to 12.5% to Soften Final Move

Gibraltar, one of more than a hundred nations that approved the global tax agreement to implement a minimum corporation tax rate, became the first to act upon its commitment by introducing an interim tax level.

Reaching Minimum Tax Level in Two Steps

Signaling the upcoming change in its taxation policy, Gibraltar is raising corporation tax from 10% to 12.5%, a transitional rate to smooth the impact from reaching the main goal of 15% in the coming years.

During his 2021 budget address, Gibraltar Chief Minister Fabian Picardo announced the interim change in the corporation tax level, after the country joined more than 130 other nations to sign the new international tax reform framework.

“I understand this will present challenges to this jurisdiction and its model of taxation but I do not believe it is in Gibraltar’s interest to be the outlier that would not sign up to this framework and would seek to resist it.”

Gibraltar Chief Minister Fabian Picardo

Last month, finance ministers of the G-7 countries reached a historical global tax agreement, and while Gibraltar was not present at the Summit which took place in the UK as part of the country’s Presidency of the G-7 Forum, the peninsula approved the agreement following the meeting of the international economic stimulus body of the Organization for Economic Cooperation and Development (OECD) earlier in the month.

The global tax agreement steps on a Two Pillar approach to ensure global multinational companies pay taxes in every jurisdiction they operate and not only where their headquarters are (pillar 1), and that the minimum tax they pay will be 15% (pillar 2).

The OECD proposal was also approved by countries like the US, the UK, Germany, France, Netherlands, Sweden, Spain, Portugal, Malta, and others, but Gibraltar becomes the first to put the proposal into action.

Soften the Blow to Online Gambling Operators

Ricardo believes the introduction of an interim tax rate would soften the blow to online gambling operators as compared to a direct implementation of the agreed minimum tax level. To further soften the impact, the Gibraltar chief minister announced allowances and incentives for corporations willing to invest in employment, training, and marketing.

The increase of the tax burden on online gambling operators headquartered on the peninsula was addressed by a spokesperson for the Gibraltar government. Labeling the increase in corporation tax as part of the preparation process for the country to comply with international standards, the spokesperson expressed the government’s belief gambling operators would welcome its commitment.

Comparing the interim tax with the current tax in Ireland, the spokesperson said, “We do not believe this rise in rates will have any negative impact on our operators”.

With 5+ years of experience as an analyst, Julie—affectionately known as 'Jewels' in the office—has quickly become our go-to expert in the forex and cryptocurrency space. Her keen attention to detail and deep understanding of the industry make her an invaluable asset. Julie's expertise and enthusiasm have made her the top choice to co-pilot educational initiatives alongside Mike, bringing knowledge to the masses.

More Articles