- Casino

- By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Georgia

- Florida

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Massachusetts

- Maryland

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

- By State

- Slots

- Poker

- Sports

- Esports

Sale of Crown Resorts Appears Ready to Advance, But Maybe Not to Blackstone

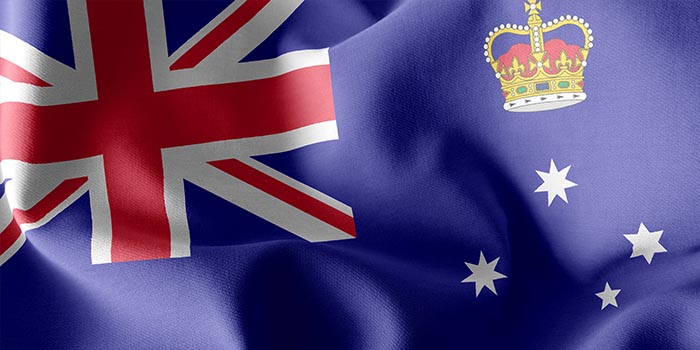

Once a reining giant in Australia’s casino market, Crown Resorts has found itself spiraling downward the past couple of years. The casino operator has acknowledged it made a series of missteps, including not preventing money laundering at its properties, and is facing scrutiny across the country. As the saga continues to unfold, Crown’s board has realized the best option might be to sell the company, but its largest shareholder, company founder and former CEO James Packer, has a lot of control over any movement. Negotiations have already begun with US-based investment firm Blackstone; however, a twist added this week might have a potential sale heading in a new direction. The Australian Financial Review has confirmed that asset management firm Moelis Australia will now be involved.

Packer Taps Asset Management Firm to Control Stake

Crown has already been deemed unsuitable to hold a casino license in New South Wales and could potentially meet the same fate in other regions of the country once more investigations are complete. Executives have been abandoning ship as tales of money laundering, illegal business deals and warlord gambling continue to surface. Packer, who has reportedly still run the company at times from behind the curtain after stepping down, has been interested in unloading his stake for several years and is now getting serious with the appointment of asset management firm Moelis Australia to oversee any sale.

The potential sale of Crown assets to Blackstone has received a lot of attention, even though it was known that regulators were going to very closely scrutinize any deal. Blackstone has offered $6.2 billion for the company and, after initially agreeing to allow Crown’s Board of Directors to lead the way, Packer wants Moelis to be his guide. Packer owns 37% of Crown, making him the largest shareholder, through his Consolidated Press Holdings (CPH) investment firm, and Moelis will now determine the best route to take moving forward.

Moelis Australia is a branch of Moelis & Company, an independent investment bank that offers an array of financial advisory services to large companies and governments, particularly in the areas of mergers and acquisitions and restructurings. The company is intimately familiar with Crowns inner workings and was present two years ago when Wynn Resorts sought an opportunity to purchase the operator. This time around, UBS is acting as Crown’s adviser, but, as the largest shareholder, CPH has a lot of weight to determine how any potential sale is structured.

Crown Board Not in Control

Packer had previously indicated that he might be willing to follow the Board of Directors’ lead in a potential sale; however, the recruitment of Moelis appears to indicate that there could be other options put on the table. Because of his holdings, Packer can essentially start or stop a deal and how Moelis views any arrangement will most likely impact his decisions. The firm might decide that the deal with Blackstone makes the most sense, or it could suggest that another candidate be sought. Additionally, it could agree with the Board of Directors and push for the sale to Blackstone.

CPH issued a statement on Tuesday regarding the recruitment, asserting that it “welcomes the Crown board’s announcement that it will commence a process to assess the proposal, and it will also engage with relevant stakeholders, including regulatory authorities, about the proposal.”

Related Topics:

Erik brings his unique writing talents and storytelling flare to cover a wide range of gambling topics. He has written for a number of industry-related publications over the years, providing insight into the constantly evolving world of gaming. A huge sports fan, he especially enjoys football and anything related to sports gambling. Erik is particularly interested in seeing how sports gambling and online gaming are transforming the larger gaming ecosystem.

Must Read

Casino

July 8, 2025

WinStar Casino Shooting Suspect Still Missing

More Articles

Legal

July 7, 2025

Former SkyCity Executives Sued Over AUSTRAC Penalty

Industry

July 2, 2025

Cirsa’s IPO to Seek Valuation of Almost $3B