- Casino

- By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Georgia

- Florida

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Massachusetts

- Maryland

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

- By State

- Slots

- Poker

- Sports

- Esports

JP Morgan: Aristocrat’s FY Revenues to Go Up by 20%

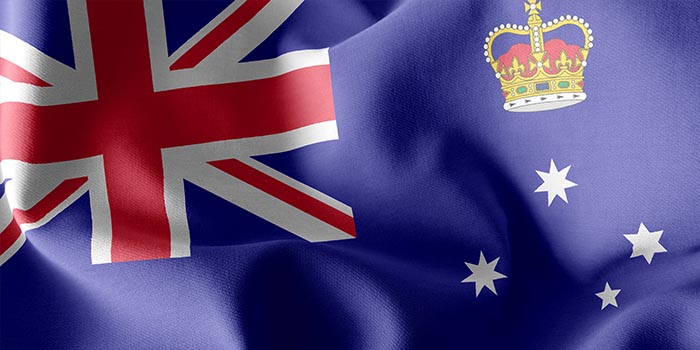

The Australian arm of JP Morgan, a global leader in financial services, announced that Aristocrat Leisure, a global gaming content and technology company, is experiencing a strong post-pandemic recovery. The finance specialists said that the company’s business has recovered beyond pre-COVID levels and will likely keep on growing.

JP Morgan Forecasts Growth for Aristocrat

Experts predict that Aristocrat’s revenues for the fiscal year will sit at around $4 billion, which represents a 20% year-on-year increase. In addition, JP Morgan specialists announced that the operator’s EBITDA will increase by a similar number (20.5%) and will reach about $1.28 billion.

By the end of September, when the fiscal year ends, Aristocrat is expected to receive around $673 million in net profits. To put things into perspective, this is 18.3% more than what the company earned last year.

Aristocrat Leisure’s strong recovery also saw its normalized net profits after tax rise by 40% for the first half of the fiscal year ending March 31.

Aristocrat’s Business Is Going Strong

Aristocrat’s strong recovery is thanks to the success of the company’s business in multiple regions. Its footprint encompasses Australia, New Zealand, the Americas, Macau and Singapore, among others. The company produces Class III slot machines for casinos and also develops iGaming content that it distributes to its partners.

Donald Carducci, an equity research analyst for JP Morgan, noted that the company had extremely strong free cash flow generation and a multi-year growth pipeline across multiple avenues. This helped Aristocrat’s business quickly pick up after the pandemic subsided.

Aristocrat recently launched its Dragon Link machines at the Mohegan Sun Casino in California. Ten days ago, it also launched $1 million jackpot games at Hard Rock Hotel & Casino Hollywood and Tampa. In addition, Aristocrat is expected to roll out its iGaming products in two states by the end of the year. The latter also contributes to JP Morgan’s favorable forecasts.

Aristocrat Should Be Vigilant

Despite Aristocrat’s strong recovery, the company should be cautious about the changing trends. Carducci noted that the Australian market is seeing a consistent decline in electronic gaming machine expenditure. To elaborate, per-capita gaming expenditure is now 0.7% less than what it was in 2007-2008.

Because of this, the analyst prompted Aristocrat to be vigilant especially when it comes to its home market. Carducci also noted that the contemporary audience tends to prefer more sophisticated tech such as VR and skill-based gaming. He advised Aristocrat to closely follow the shifting trends and to adapt accordingly.

Must Read

Business

June 24, 2025

The Star Overhauls Team with Multiple Appointments

More Articles

Casino

June 30, 2025

Vietnam Greenlights $2B Van Don Casino Resort

Casino

June 30, 2025

BC.Game Player Turns $20 Bet into $100K+ Payout

Casino

June 30, 2025

Hard Rock Executive Under Fire Due to Alleged Misdeeds

Casino

June 30, 2025

Wynn COO Vows Change Amid Ongoing Regulatory Pressure

Casino

June 30, 2025

DIMOCO Enters Germany iGaming Market with Neo.Bet

Casino

June 30, 2025

Man Admits to Laundering Cocaine Money Through Casinos

Industry

June 27, 2025

Gambling Harm Costs Victoria, Australia, Over $9B